Card payments

Payment cards

Digital Payment Card Activation (non-plastic)

- Tap "Cards" in the bottom menu on the home page.

- For the selected card tap "Activate".

- Read the tip on how to upload a card to your mobile and tap "Continue".

- Confirm the request with Smart Key.

- That's it! Press "OK" to return to the card overview.

See PIN for New Card / PIN Forgotten

TIP: Ask Kate in ČSOB Smart: “I need the PIN for my card.”

- Tap "Cards" in the bottom menu on the home page.

- For the selected card, tap the "PIN" button.

- Confirm the request with Smart Key.

- Read the notice and tap "OK".

- Done, now we will display your PIN.

Allow or Ban Online Card Payments

- Tap "Cards" in the bottom menu on the home page.

- Under the selected card tap "Card limits and settings".

- In the "Of which internet payments" section switch the toggle next to "Allowed" on or off to allow or disallow the service.

- Confirm the request with Smart Key.

- That's it! Press "OK" to return to the card overview.

Display Payment Card Number

- Tap "Cards" in the bottom menu on the home page.

- Next, tap "Card number" under the card you are interested in.

- Confirm the request with Smart Key.

- Read the info and select "OK".

- First, we will display the front of the card. Press "Turn card" to see the back of the card, including your CVV code, which you need for online payments.

Forgotten or Blocked PIN

TIP: After your PIN is blocked, the card will be temporarily blocked for PIN transactions. The card unblocks itself the next calendar day, but can be unblocked earlier by displaying the PIN.

- Tap "Cards" in the bottom menu on the home page.

- For the selected card, tap the "PIN" button.

- Confirm the request with Smart Key.

- Read the notice and tap "OK".

- Done, now we will display your PIN.

Change Payment Card Limits

- Tap "Cards" in the bottom menu on the home page.

- Under the selected card tap "Card limits and settings".

- Pick the "Weekly limit" you wish to change.

- Enter the new limit and click "Confirm".

- Confirm the request with Smart Key.

- That's it! Press "OK" to return to the card overview.

How to order an additional card

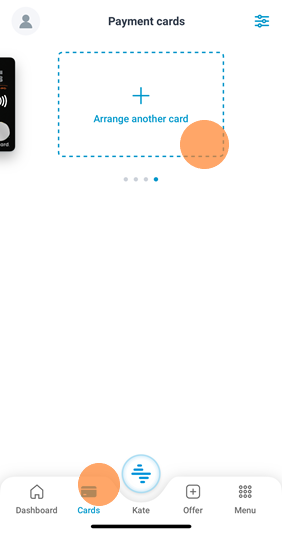

- In the bottom menu, select Tabs. On the far right of the card selection, select Arrange another card.

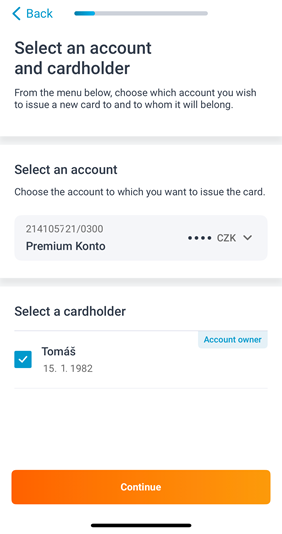

- Select the account and cardholder for whom you want to order the card.

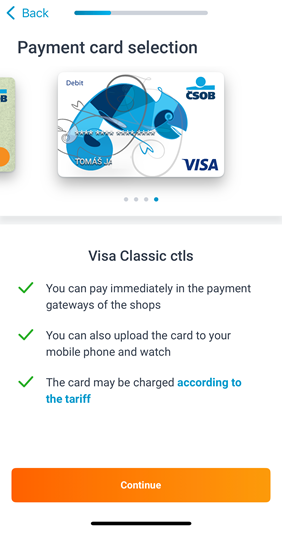

- Select the card type (for cards with a sports club logo, either Visa Classic or Debit MC ctls).

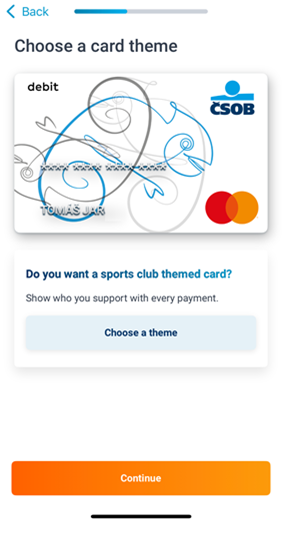

- Select the Choose a theme button if you are interested in a card with a sports club logo.

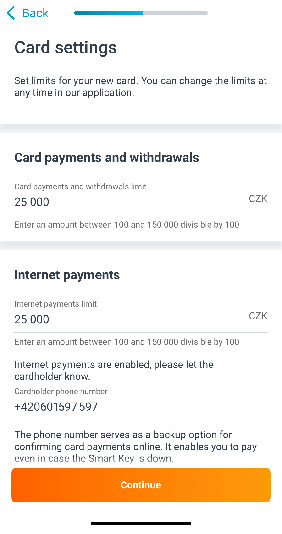

- Set your limits and number for SMS codes (as a backup in case of Smart Key failure).

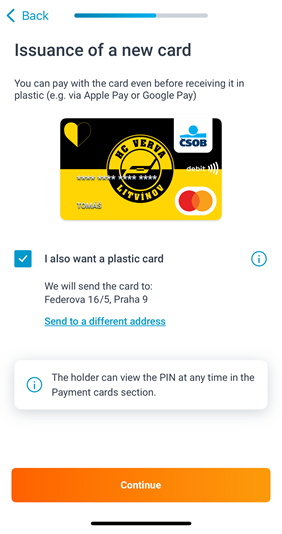

- Choose whether you want and plastic card. You can also customize the address where the card will be sent.

- We will show you the business terms and conditions and other required documents.

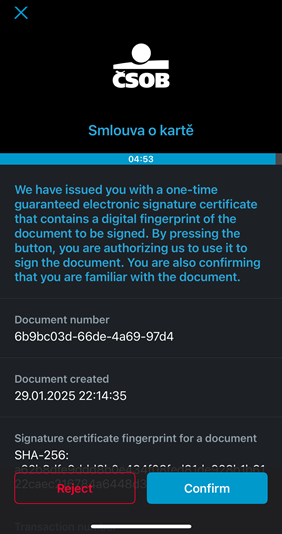

- You will sign the contract electronically in the Smart Key app.

- The application will take time to process a few seconds, please hold on.

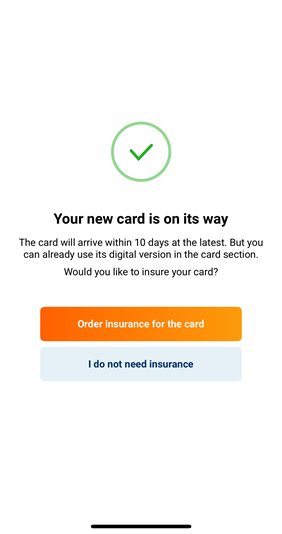

- Done, you have your card ordered and you can insure it against loss and theft.

Initial Setup and Change of Phone Number for 3D Secure

TIP: Initial setup and change of your phone number for 3DSecure can only be done after you enter your ePIN via Internet Banking. First, set up your ePIN for use as a backup option if you lose your phone or if the Smart Key is down.

- Click on “Cards” in the left menu.

- Click on the three horizontal lines next to the selected card and select “Set up online payments (ePIN)”.

- Select “Yes” next to “Enable online payments” and enter or edit the following details: ePIN settings, Weekly limit (for internet card payments), Phone number and then click "Continue".

- Confirm the request with Smart Key or SMS Key. Your ePIN is set up.

Text instructions for setting up On-line banking

Digital payment card activation (without plastic)

- Select the "Cards" section.

- Click the menu icon next to the card you would like to activate.

- Click the "Activate" button. This option can also be found in the tab details where you can change your settings.

I need to get a PIN for my new card/ I forgot/ blocked my PIN

- In the left menu, click on "Cards".

- Then click on the three horizontal lines symbol.

- Select "Show PIN".

- Click "Continue".

- The system prompts you to authorise with a Smart Key or SMS key.

- After authorisation, you will have your PIN displayed/unlocked if necessary.

Set and change your ePIN

TIP: Read about what an ePIN is and why you should set one up here. As with your card PIN, you set your ePIN for each card separately.

The initial setup and change of your ePIN can be done via internet banking or at a CSOB ATM.

- In the left menu, click on the "Cards" button.

- Then click on the symbol of the three horizontal lines and select "Set up on-line payments (ePIN)".

- Select "yes" for "Allow on-line payments"

- Click on the plus sign to set your ePIN and confirm it in the second row.

- Confirm with your Smart key or SMS key. After successful authorisation, your ePIN will be changed.

Enable or disable on-line card payments

The initial setup must be done in On-line banking, where you set all the parameters (ePIN, limit amount, and 3DSecure phone number). Subsequent management can also be carried out in the ČSOB Smart mobile app, where it is possible to enable, disable and change the limit.

- Select "Cards" from the left menu.

- Then click on the symbol of the three horizontal lines and select "Set up on-line payments".

- Select "yes" or "no" for "Enable on-line payments".

- Confirm with your Smart key or SMS key. After successful authorisation, your card payments will be set.

View your payment card number

- Choose "Settings" in the Menu

- Then click on the three horizontal lines symbol and select "Show card".

- Click "Continue".

- Confirm with your Smart key or SMS key. Your card info will be displayed.

Changing your card limit

1. Find detailed information about card limits here.

Limits for card payments at branches or ATM withdrawals

- In the left menu, click on the "Cards" button.

- Then click on the three horizontal lines symbol and select "Change limit".

- Set your limit and click "Continue".

- Confirm with your Smart Key or SMS code. You're all done, you've set your card limit.

2. Limits for On-line card payments

ATTENTION: This limit cannot be higher than the total weekly limit for payments and withdrawals.

- In the left menu, click on "Cards".

- Then click on the three horizontal lines symbol and select "Set up on-line payments".

- Set your limit and click "Continue".

- Confirm with your Smart Key or SMS code. You're all done, you've set your card limit.

I need to change my card. Where and how will my new card arrive?

- Select "Cards” from the left menu.

- Click on the three horizontal lines symbol and select "Card Detail". In the "Card sent to you" and "Address" fields, you will find the method of sending and the address where your card will be delivered.

- In the "Card sent to you" menu, click "Change" and choose whether you want your card delivered by post, to a branch, or plastic-free (virtual card).

- In the "Address" menu, click "Change" and set the address where you want your card to be delivered. But you must be set up to receive your card in the mail.

FAQ

Read the answers to frequently asked questions about credit cards

How do I activate a plastic payment card?

Always pay by contact the first time you use your card. This means that when withdrawing from an ATM or paying at a payment terminal, insert the card inside and enter the PIN. This will activate the card. Future payments will be contactless when placed to a contactless card reader.

TIP: Read on how to use credit cards safely.

How do I block my card due to loss, theft or misuse?

Find out more here.

How do I change my credit card PIN?

If you are not happy with your PIN, you can change it at any of our ATMs. Select "Change PIN" from the main menu and follow the instructions. Just be careful, you will need a plastic card (even a contactless one), you can't use a virtual card.

How to use a credit card safely?

Find out more here.

I found the card I had temporarily blocked earlier. What now?

You can unblock a temporarily blocked card just as easily as you blocked it - in On-line banking or in the ČSOB Smart app.

- In ČSOB Smart

In the bottom menu, select the "Cards" tab and click on "Settings". Select the desired card and "Unblock". - In On-line banking

In the main menu, select the "Cards" tab and click on "Card Detail", then select "Unblock".

If there is even a small chance that someone may have misused your card or copied numbers from it, call 495 800 111 and have the card permanently blocked. Read about the difference between temporary and permanent card blocking.

I found a card that I had permanently blocked before.

You can't unblock a permanently blocked card again, it's no longer of any use to you. All you can do is wait for a new card to arrive.

I found someone else's card. What should I do with it?

The safest way is to permanently block the credit card over the phone. You can usually find the contact details of the helpline on the back of the card.

An ATM put a hold on my card

If an ATM has not returned your card, call your card issuing bank. For ČSOB, call 495 800 111.

My payment card didn't arrive

Automatic renewal (I have an expiring card)

The new card usually arrives in the middle of the month during which the old one is due to expire. If there are less than 10 days left and you are still waiting for your new card, please call 495 800 111. The validity of the card is stated in MM/YY format and the card is valid until the last day of the month indicated.

Also, check where your card will arrive. In On-line banking, click on "Cards" in the left menu, then click on the three horizontal lines symbol and select "Card Detail". In the "Card sent to you" and "Address" fields, you can see the address where we deliver your card.

I applied for a new card after it was permanently blocked. When will I get a new card?

After permanently blocking your card, your new card will arrive within 10 working days . If you are still waiting on your card, please call 495 800 111.

I'm not sure if my card is only virtual

Not all the cards we issue are plastic. Those who only pay by mobile phone or on-line do not need a plastic card. In such cases, we can issue a virtual card only - no need to waste plastic and clutter up the post office.

You may be unsure and want to check whether you have ordered an actual plastic card. In this case, log in to your On-line Banking and select "Cards" from the left menu. Then click on the three horizontal lines symbol and select "Card detail". In the "Card sent to you" field, you can see whether your plastic card will arrive at a branch or by post. If you select plastic-free, you will only be issued a virtual card.

The ATM did not dispense money/cash or failed to credit my deposit

If an ATM has held your money, failed to dispense cash, failed to credit your deposit, or failed to return money from a merchant, etc., please file a complaint. It doesn't depend on the ATM you used, but on the card used. In other words, you always claim the transaction with the issuing bank.

I am unable to pay by card

- First, check your credit card limits.

- If you failed to make a contactless payment at a store, try inserting your card directly into the terminal.

- When paying by credit card on-line, check your credit card settings (3D Secure, ePIN)

Using your card abroad

General information:

It's just as easy to pay with your credit card abroad as in the Czech Republic. There is no charge for foreign card payments, the amount is just converted at the current exchange rate.

Be aware of DDC:

With card payments or withdrawals from ATMs abroad, you may encounter the option of converting to Czech currency (Dynamic Currency Conversion). It sounds like a good idea, but don't do it. The problem is that the amount is converted according to a disadvantageous exchange rate which the ATM or terminal operator profits from. We recommend that you decline this option and always pay in the local currency, such as euros or dollars.

Worried about getting confused at the ATM and selecting the wrong option? Read more about DDC.

Travelling outside Europe:

If you are travelling abroad, we recommend that you call 495 800 111 before you leave to let us know if you plan to leave Europe.

How do I activate my mobile wallet card?

RECOMMENDATIONS: To upload a payment card to your mobile wallet, make sure your card is activated. Instructions on activating your card can be found in the video tutorial "Digital payment card activation (without plastic)".

Apple Pay

Supported devices: iPhone with Face ID or Touch ID (except 5S)

How do you activate Apple Pay: After you log in, click on "Cards". Select your card and then "Apple Pay". Digitisation will commence and you will receive confirmation of the digitisation by SMS or e-mail.

Read more about Apple Pay.

Google Pay

Supported devices: Android mobile phone (without root) and NFC or smartwatch with Wear OS 2.15 or later.

How to activate Google Pay: After you log in, click on "Cards". Select the card and then "Google Pay". Digitisation will commence and you will receive confirmation of the digitisation by SMS or e-mail

Read more about Google Pay.

Garmin Pay

Supported devices: Garmin smartwatch with NFC chip and Garmin Connect synced app on your mobile phone.

How to activate Garmin Pay: In the main menu of Garmin Connect app, select Garmin Devices and select your watch. Click on "Garmin Pay", choose "Create Wallet" and set a four-digit code to unlock the watch for payments. Enter the card type and details, or scan your card via your camera. You can also add optional contact details. Choose “Use the CSOB mobile app”. Open CSOB Smart Key app and confirm the pending request. (Note: you may notice error screen “Verification failure” that can be ignored). You will receive SMS or e-mail confirmation.

Read more about Garmin Pay.

Xiaomi Pay

Supported devices: Compatible devices (for example, Xiaomi Mi Smart Band 6+7 NFC smart bracelets and others) and the Mi Fitness (Xiaomi Wear) App (originally Zepp Life or Xiaomi Mi Fit), which you can download for free from Google Play or the App Store (used to pair your mobile phone with the bracelet).

How do you activate Xiaomi Pay: Download the Mi Fitness (Xiaomi Wear) app for Android or Apple iOS and create a profile. Pair your device with the app - in the app, select "Devices > Add device" and pair. Click on the Xiaomi Pay icon in the app and set your PIN. Click on Xiaomi Pay, select Add, and fill in the card details (card number, embossed name, expiry date, CVV), and continue on to the next confirmation screen. Mi Fitness app displays text „Bank application“ that is not active to click. Now open the banking app CSOB Smart Key and confirm the request.

And you're done – you will also receive a confirmation SMS or e-mail about adding your card to Xiaomi Pay.

Read more about Xiaomi Pay.

Click 2 Pay

Read about Click to Pay and how it works.

How to order another payment card?

Apply for a debit card in the Cards menu > Arrange another card. You can choose between the Eco Card, Gold Card and Sparta Card. If you want a card with a different sports club logo, select the Debit MC ctls or Visa Classic types, click on Choose a theme and you will see all the options. Choose one and choose if you need a plastic card or if a digital version (e.g. for Apple Pay / Google Pay) is enough.